Webinar: What will the Indian Economy look like post COVID-19

Our webinar on 23rd June focused on the Indian economy post COVID-19, in which UKIBC Director Chris Heyes was joined by Pranjul Bhandari, Chief India Economist at HSBC; Vaidison Krishnamurty, Partner – Deals Practice and Lead of the UK-India Corridor at PwC India; and Piusha Bose, Counsel and Co-Head of the India Group at Freshfields Bruckhaus Deringer.

Our experts shared their insights on the macro-economic challenges India faces and covered the fiscal measures the Indian Government has put in place. They further reviewed the current scenario, what more the Government can do, and emerging trends and predictions looking into 2021 and beyond, both from a general and sector-specific perspective.

Last week, the rating agency Fitch said the coronavirus pandemic has significantly weakened India’s growth outlook for this year and exposed the challenges associated with a high public-debt burden. Matching Moody’s view, it has downgraded India’s outlook from stable to negative.

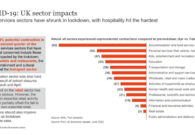

Many observers say the Indian economy will contract in the current FY owing to the lockdown, though expectations are for a bounce back in FY21-22. This however does not tell the full story. As we know, some sectors have been affected more than others – telecommunications, IT services and pharma far less than airlines, travel, and automotive industries for instance.

Unfortunately, a number of businesses will no longer be viable at their current scales in the new normal. Therefore, cash rich business may see new acquisition opportunities, and those which are struggling might see opportunities via mergers to reduce cost bases through shared services, facilities, and staff.

According to our experts, the Government of India (GOI) has done the necessary – for example, small loans, provision of grains, and eased regulations – but it has not done everything possible and there should be further reforms to come. There could be better implementation of provisions such as the large loan guarantee programme, by making it more functional and accessible. The Reserve Bank of India (RBI) could further cut rates, and there could be more cash transfers for the urban poor in addition to rural.

PM Modi has correctly identified some of these problem areas, namely the four L’s of land, labour, liquidity, and law. Reforms in these areas are not just critical, but necessary for India to return to its growth levels of the first two decades of this century.

There are some positive signs: IT exports, for example, could grow and inflation has remained low. The rupee is also relatively strong.

Yet, sectors that have a high discretionary spend by customers are likely to struggle throughout the current financial year, such as auto, travel and tourism, financial services, and real estate, because consumers and companies are trying to save cash where possible.

Those sectors which can operate online, for instance education, IT, and retail, are likely to be the quickest to recover. Online learning is seeing a huge increase in demand, and companies and consumers are seeing the benefits of digitisation.

M&A may look a bit different due to cash challenges and uncertainty, while sectors and players will become relevant at different times. There is sure to be some activity, however, as those firms that can adapt best will find opportunities in the market.

So, India is meeting necessary demands that its population desperately needs. Concurrently, there is more to do to address existing, and now compounded, growth challenges. The country based much of its recent growth on consumption which has dried up in recent months, and all but stopped during the strict lockdown. As companies and individuals attempt to conserve cash, India must address its liquidity issues first and foremost.

We invite you to watch our webinar in full using the video player below: