India’s Gaming and Animation industry: Tips from an insider

On August 27th, the UKIBC held its first interactive webinar. The topic was India’s gaming and animation industry, and it featured two insightful speakers well acquainted with the industry.

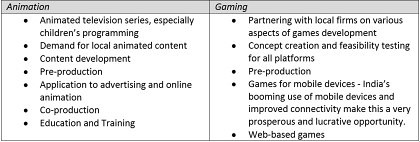

Opportunities in India’s gaming and animation

At the webinar, Ashish Mehta, First Secretary, Creative industries at UKTI Mumbai shared his expert knowledge on the industry’s growth, forecasts, opportunities and routes to market. And then Anand Gurnani, Co-founder, CEO and Managing Editor of AnimationXpess, provided an insider’s perspective of India’s animation industry, with a helpful and candid view on what it takes to partner successfully with an Indian company.

Based on their insightful presentations, below you will find a summary of this informative event. If you are interested in accessing the full presentations and/or a recording of the webinar, please contact Radhika.Pandey@ukibc.com.

Animation and Gaming in India: An overview

Ashish Mehta from UKTI spoke about the sectors’ market size, growth and projections. Both the animation and gaming segments have yielded growth over the last 3 years, with animation projected to reach more than £500 million by 2014, and gaming more than £250 million by the same year.

India’s animation and gaming industry has increasingly become well regarded for its high quality and low cost. However, consensus seems to be growing that India should not only be regarded as a low-cost destination for outsourcing, as the country’s vast talent pool and appetite for investment have much more to offer.

In recent years, there are good examples of international successes. Giants like Walt Disney, Imax, and Warner Bros are in the final stages of signing deals with Indian animation companies for outsourcing and co-production. Meanwhile, DreamWorks Studio has partnered with Indian heavyweight Reliance Entertainment. As Ashish mentioned, many well-known international films have had post-production done in India, including Shrek, Kung Fu Panda, Pirates of the Caribbean, the Harry Potter series, Avatar and Life of Pi, among others.

India’s well-known geographical hubs for animation and gaming are: New Delhi (North); Mumbai and Pune (West); and Bangalore, Hyderabad, Chennai and Trivandrum (South); with a noteworthy concentration of companies and studios in these regions

To successfully access the market, Ashish highlighted the importance of due diligence in finding a good local partner with solid technical skills, and visiting the market to establish a network of contacts.

Common concerns and top tips

The UK is well positioned to make inroads in India. The common English language is advantageous, and the UK is broadly regarded as a leading country in the generation of IP. However, there are many concerns and misconceptions that should be taken into account.

The Indian market has evolved considerably and has developed many highly reputable centres of technological excellence. Moreover, India’s talent pool in this sector is outstanding, counting with 200,000 students in the animation and gaming pipeline and 9,000 faculty members.

Many foreign investors in the animation and gaming industry considering India worry about the reliability of local partners, for instance about on-time delivery of projects. Our speaker, Mr Gurnani, shared insights on this, stating that there have already been many shows successfully produced in partnership with India, with an average of 80% of projects delivered on time.

In regards to remuneration paid by Indian broadcasters, Mr Gurnani said that, in average, rates between 20,000 and 45,000 USD are commonplace for a half hour episode of acquired/commissioned original indigenous content.

India continues to be a booming market, with the largest addressable market size of children’s audience and a fast-growing access to technology. One of the main tips that emerged from the webinar discussion is to indeed consider investing in India, while at the same time consider India as a potential investor for your UK projects.

By Kealan Finnegan

By Kealan Finnegan