‘Make in India, finance in the UK’ says Chancellor as India visit begins

The Chancellor is leading a delegation to Delhi and Mumbai this week, where he has pledged to "bang the drum" for UK business

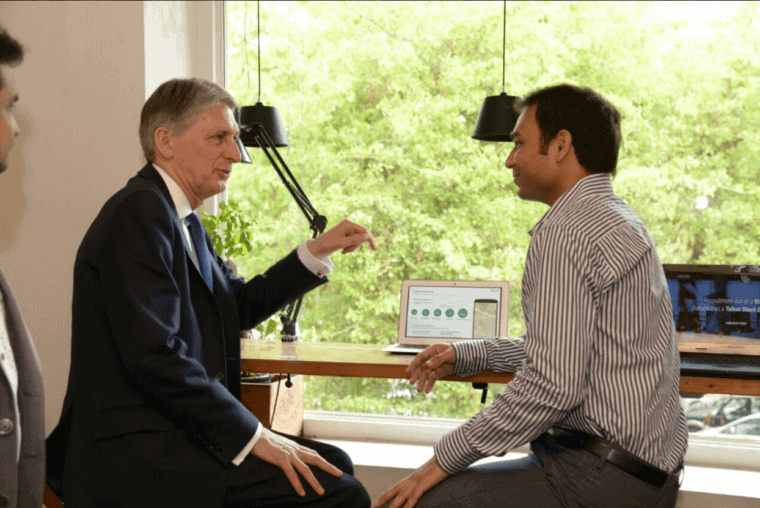

Image credit: HM Treasury/Twitter

Britain’s position as a world-leading finance hub, India’s ambitious growth plans and the UK’s vision to build a Global Britain present an unbeatable combination for the two nations to take their relationship to the next level, the Chancellor of the Exchequer, The Rt Hon Philip Hammond MP will say on a visit to Delhi and Mumbai this week.

Referencing Prime Minister Modi’s ‘Make in India’ vision, which is devised to transform the country into a global manufacturing hub, Philip Hammond will set out how the UK is perfectly placed to become India’s leading finance partner to help it deliver on its plans.

The Chancellor is leading a high level business delegation for talks in Delhi and Mumbai, alongside the Governor of the Bank of England Mark Carney and government ministers, including the Commercial Secretary Baroness Neville-Rolfe and International Trade Minister Mark Garnier, the latter of whom paid a visit to the UK India Business Council’s new office in Gurgaon earlier this week.

The visit is part of the annual UK-India Economic and Financial Dialogue and the Chancellor’s delegation includes some of the UK’s most experienced leaders in financial services and some of Britain’s most exciting FinTech entrepreneurs.

The UK is already the world’s largest exporter of financial services and the leading centre for FinTech.

India’s ambitious growth aspirations require it to develop its financial infrastructure and tap into global investors, with estimates suggesting that it needs over $1.5 trillion of capital in infrastructure investment alone in the coming years.

The UK and the City of London are therefore perfectly placed to be India’s partner of choice to raise the finance it needs to deliver on its plans, the Chancellor will say.

He will also recognise the major opportunities for collaboration for British FinTech firms specifically as India continues its drive towards a society less dependent on cash, using technology to increase access to banking and finance for everyone.

This ongoing push across India means that its finance sector is undergoing a significant transformation, with new payment firms, small finance banks and insurance players entering the field.

This shift presents enormous opportunities for the UK to work much more closely with India’s own exciting FinTech sector, and so this week’s visit includes some of the UK’s most exciting new FinTech firms, such as TransferWise and World First – who are actively looking to expand their activities and interest with India.

The UK and India already share strong links in these areas. Almost 80% of all masala bonds have been issued in London. British firm Standard Chartered, who employ over 18,000 people in India, recently sponsored a new Chevening Scholarship programme between the 2 countries. This will see 8 top Indian leaders of the future attend an intensive course in financial services in London this year.

The trip is also a significant opportunity, following the triggering of Article 50, for the Chancellor to discuss Britain’s new role in the world, as it prepares to revitalise its links with friends and allies, opening up new markets and new opportunities for British businesses.

The Chancellor Philip Hammond, on arriving in India, declared his intention to “bang the drum for British business,” adding that it the UK is looking to “boost trade and investment beyond the borders of Europe… with the world’s most vibrant economies.”

To find out more on India – the business environment – please follow this link